Atom × AI = Affordable?

Pre-Introduction

Let’s jump ahead. The year is 2030. AI is no longer a novelty—it’s the wallpaper of corporate life. Every “maybe AI could help here?” idea has been thrown at the wall. Some stuck. Most didn’t. That’s the messy reality of trial and error at scale.

But after the noise cleared, one truth emerged: from HR to design to manufacturing, the winners in this AI lottery are now embedded everywhere. They’re not apps you try once and forget; they’re infrastructure. They quietly (or loudly) crank productivity up across the board.

And when that happens, the downstream impact is simple but seismic: the unit economics of physical products flip. If it costs less to dream up, build, ship, and support a device, then an iPhone becomes a very different economic animal.

This piece is about following that thread.

What happens when the entire production stack of a product is soaked in AI?

Does the cost collapse? Do prices fall with it?

Or does a company like Apple just laugh all the way to the bank while the rest of us pay the same USD 1,200 for a shinier rectangle?

I have collated information from a few sources, cited at the end of the post.

Introduction

It’s 2030. The iPhone 30 is here, and Apple is once again standing on stage with a shiny rectangle in its hand. On the surface, not much has changed — new titanium alloys, new camera tricks, new silicon that makes yesterday’s phone feel slow. But underneath, everything about how that device came to life is different.

AI is no longer a side project. It’s the infrastructure of Apple’s business. Over the past decade, every “what if we use AI for this?” experiment got its shot. Most fizzled out. But the ones that worked dug themselves deep into the company’s operations. Design studios, testing labs, customer support lines, factory floors — they all run on machine learning now.

That matters because Apple’s costs have been quietly bent downward. The iPhone still sells for almost USD 1,000 on average, up from about USD 870 back in 2024. But the dollars Apple spends to design, assemble, ship, and support each one? They’ve shrunk. And that gap — higher price, lower cost — is the margin story of the 2030s.

Numbers

Before we start, let’s get some perspective of their numbers in 2024 and how they compare.

Units sold in Millions on left y-axis and Revenue in Billions on right y-axis.

I am guessing a convergence to USD 1000 per unit by 2030.

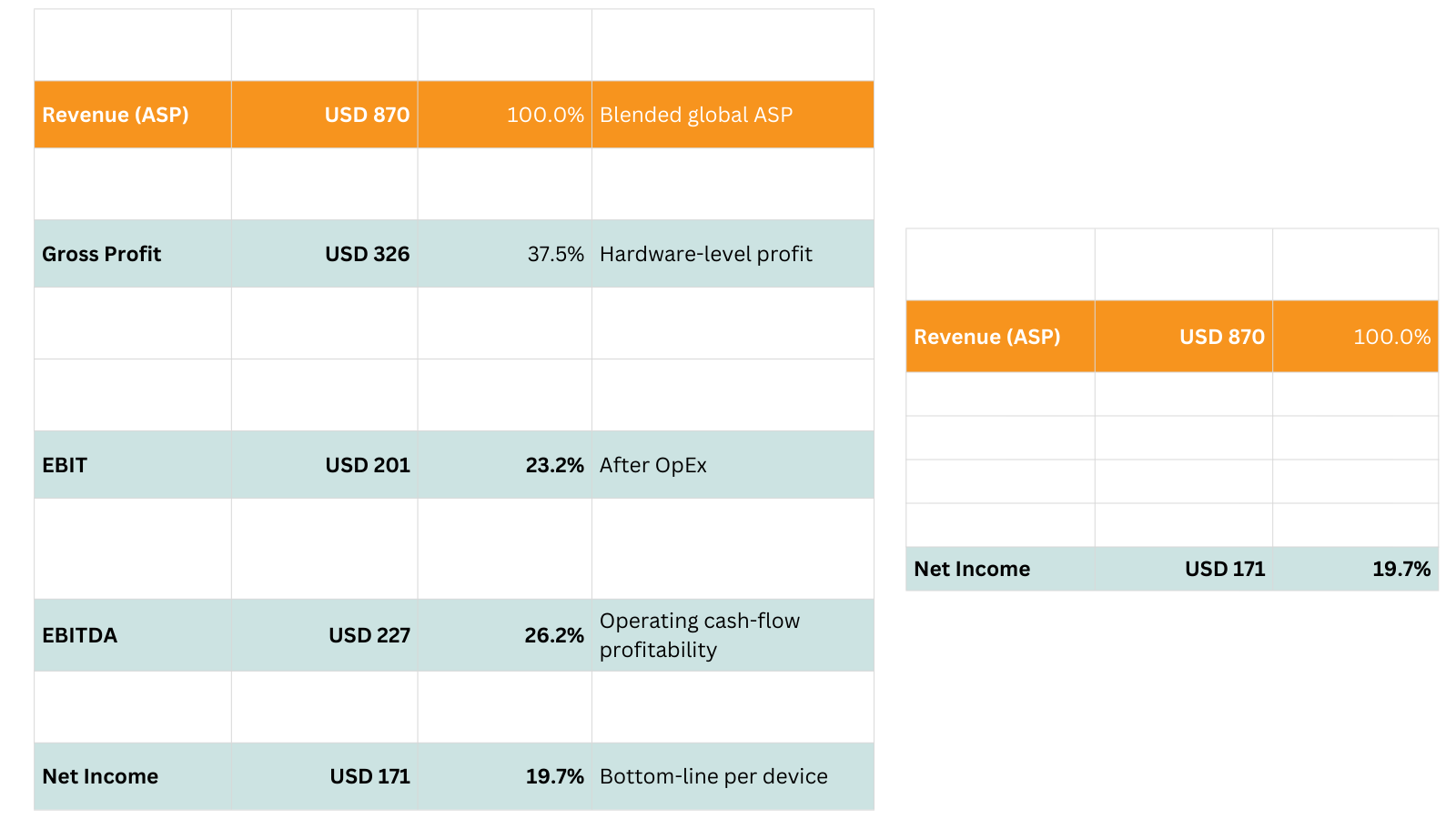

Let us focus only on 3 components - COGS, R&D and SG&A as done in the illustration above (the table on the right).

Three small things:

Anyway, the other components won’t be affected much by AI.

P&L of a unit that runs a single product type is the same as the Unit Economics of the average product.

R&D and SG&A are spread evenly across units in Apple.

From the projections in the graph above, as of 2030, they have been selling consistently and the Average Selling Price of the iPhone has been increasing from ~870 USD per unit to nearly 1000 USD per unit.

With the state of affairs like in the above graphs in 2024, the question is how does the Net Income change in 2030?

AI Everywhere

COGS

The most dramatic shift is in the Cost of Goods Sold — the physical cost of each iPhone. In 2024, the higher end Pro Max BOM (bill of materials) sat at about USD 558, for a device that retailed around USD 1,199. Roughly half the price tag was cost, half was margin. AI has pushed that balance.

Assembly lines are no longer seas of workers. Apple began replacing humans with robots in the late 2020s, aiming to cut headcount by as much as 50%. By 2030, that’s reality. Labor costs were never the biggest slice of the BOM — maybe USD 10 per unit — but halving them still saves billions at Apple’s volumes. More importantly, robots don’t strike, don’t slow down, and don’t make the same mistakes twice.

Yields — the percentage of components that make it through production — also improved. A 1% gain in yield sounds small, but when you’re producing hundreds of millions of units, it means millions of extra sellable devices. AI vision systems now spot defective screens or misaligned parts instantly. Predictive maintenance means fewer line stoppages.

Chip production, handled largely by TSMC, also got an AI boost. By the late 2020s, AI layout tools were shrinking die sizes by up to 20%. Since the A-series chip is often 30% of the BOM, even a small improvement translates to dollars saved on every unit.And the supply chain — once Apple’s biggest vulnerability — is now fortified with predictive models. Remember the USD 6 billion hit in 2022 from supply shortages? That kind of disruption is now much less likely. AI models reroute shipments, anticipate bottlenecks, and keep inventory levels tight.

Add it together, and Apple’s unit cost dropped by 5–10%. Across USD 200 billion-plus in iPhone revenue, that’s a USD 10 billion improvement in profit for every 5% COGS reduction.

R&D

Apple’s R&D bill used to hover around USD 30 billion a year. That money bought engineers, labs, and endless prototype iterations. Today, AI has hardwired speed into the process.

Generative AI is now standard inside chip design software. What once took teams months of layout work is done in weeks, sometimes days. Apple’s hardware chief Johny Srouji hinted at this years ago when he said generative design could be a “huge productivity boost”. Industry data has backed it up:

chip projects can be completed with 30–50% shorter design cycles and

as much as 3–5× productivity gains for engineers.

Apple leaned hard into that, especially as its A-series chips became more complex at 3nm and below. Verification and testing also got faster. Where debugging a silicon design used to stretch into months, AI-assisted tools now spot problem areas almost instantly. Analysts tracking semiconductor workflows have put the time savings at up to 70%.

The result - fewer prototype runs, lower lab costs, faster time to market.

Even Apple’s software engineers got swept up in this shift. Coding assistants generate boilerplate, refactor old code, and propose performance optimizations. It doesn’t replace the teams, but it gives each engineer leverage. Internal productivity studies at large firms showed double-digit improvements in developer output once AI copilots were deployed, and Apple has had those advantages at massive scale.

Put all of this together and R&D is leaner by at least 10% — roughly USD 3 billion a year saved — without slowing the pace of innovation. In fact, Apple’s chip roadmap only accelerated. Push the tools to their limits, and the savings climb closer to 20–30%, the kind of numbers EDA vendors have been whispering about since the mid-2020s.

SG&A

Selling, General, and Administrative costs, the lump sum that covers everything from AppleCare support to logistics and marketing, were about USD 26 billion in 2024, roughly 7% of sales. By 2030, AI has carved into that.

Customer support is the most obvious example. Call centers used to be staffed by thousands of people handling routine questions. By the late 2020s, Apple had rolled out advanced voice agents and chat systems, built on the same natural language tech that once powered Siri. IBM once reported chatbots could cut routine support costs by around 30%, and telecom operators who rolled them out early saw per-chat costs fall by 70%. Apple scaled that lesson globally. Today, AI handles the first line of nearly every customer interaction, escalating only the tricky cases to humans. Even if only 20% of total SG&A costs fell, that’s still about USD 4 billion a year saved.

Logistics and distribution are the second frontier. AI models predict iPhone demand with uncanny accuracy, reducing the need for excess inventory or expensive last-minute shipments. Back in 2022, McKinsey surveys of early adopters showed AI cutting logistics costs by 15% and improving inventory turnover by more than a third. Apple’s scale magnified those gains. Route-planning algorithms shave 5–10% off freight costs. Warehouse automation means fewer errors and fewer people required to keep products flowing.

Even the quieter parts of SG&A — ad spend, procurement, internal finance — run on AI optimization. Targeted marketing reduces wasted dollars. AI procurement systems squeeze suppliers on pricing more effectively. These aren’t headline-grabbing, but together they make the whole SG&A line leaner.

By 2030, SG&A as a share of revenue is closer to 6% than 7%, a point of margin clawed back not through austerity, but through automation.

Net Income

By 2030, three numbers tell the story:

R&D: down USD 3–6 billion a year, even as products got more complex.

SG&A: down USD 4 billion or more, with smarter support and logistics.

COGS: down USD 10–20 billion, thanks to automated factories and AI-driven supply chains.

And all this happened while the average selling price of the iPhone rose from USD 870 to nearly USD 1,000.

Consumers pay more.

Apple spends less.

The margin gap in the middle has widened.

The absolute figures do increase in each case, but the contribution reduces. The unusual balance…

This isn’t a guess. Apple executives have been signaling the direction for years. Analysts studying AI in chip design, logistics, and support put real numbers to the savings. Early pilots in the 2020s showed double-digit cost cuts. By 2030, those experiments weren’t pilots anymore — they were policy.

So, does the cost collapse?

Yes, internally.

Do prices fall with it?

Not really.

Apple doesn’t pass those savings on; it banks them. The result is an iPhone that looks like a shinier rectangle on the outside, but on the inside represents one of the most profitable case studies of AI as corporate infrastructure.

Conclusion

Looking ahead, AI is set to become foundational infrastructure for Apple and the broader tech industry. Apple is doubling down on AI and silicon R&D – it’s building new U.S. fabs and data centers to power “Apple Intelligence”. We can expect more AI‑tailored chips (optimized automatically by AI tools) and smarter iPhone features (on‑device personal assistants, generative media editing, etc.) that drive up device value. In the supply chain, AI will further harmonize global logistics and even help decarbonize manufacturing. As competitors also race to infuse AI into every function, the industry’s cost structures will change: companies that lag in AI could face much higher relative costs or miss out on margin gains.

In sum, by 2030 the iPhone’s economics look very different – lower input costs, higher efficiency, and richer features – all thanks to AI woven into every process. This transformation sets the stage for new innovations (and new business models) powered by AI tomorrow. The tech sector as a whole is now moving from AI as a tool to AI as the very platform of computing and operations. In this era, Apple’s early bets – from AI‑designed chips to smart factories and intelligent services – put it ahead of a wave that will ripple through every part of the industry.

Citations

Stephen Nellis, “Apple eyes using AI to design its chips, technology executive says” (Reuters, Jun. 2025) - Link.

Michael Burkhardt, “Apple just released a new AI chatbot to help retail employees sell iPhones” (9to5Mac, Aug. 2025) - Link.

Rhys Fisher, “Apple Releases a Customer Support Agent…” (CX Today, Aug. 2025) - Link.

Jigar Dixit, “Apple’s Supply Chain: Innovation… in the Digital Age” (Medium, Jul. 2023) - Link.

Alberto Oca et al., “Harnessing the power of AI in distribution operations” (McKinsey, Nov. 2024) - Link.

Filipe Barbosa et al., “AI: The next frontier of performance in industrial processing plants” (McKinsey, Sep. 2023) - Link.

James Manyika et al., “The economic potential of generative AI” (McKinsey, Oct. 2023) - Link.

McKinsey, “How generative design could reshape the future of product development” (McKinsey, Feb. 2020) – Link.

MIT Sloan Review, “When generative AI meets product development” (July 2024) – Link.

Sangfor, “AI in Manufacturing: Benefits, Use Cases & Industry Impact” (July 2024) – Link.

McKinsey, “The economic potential of generative AI: The next productivity frontier” (Jun. 2023) – Link.